The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part of the further consolidated appropriations act.

Solar panel tax credit 2018 irs.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

The residential energy credits are.

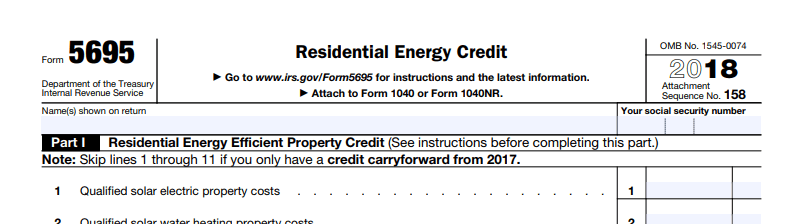

To claim the credit you must file irs form 5695 as part of your tax return.

February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

These instructions like the 2018 form 5695 rev.

Filing requirements for solar credits.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

5 minutes last updated on august 27 2020.

In addition your general business credit for the current year may be increased later by the carryback of business credits from later years.

Here are some key facts that you should know about home energy tax credits non business energy property credit.

You calculate the credit on the form and then enter the result on your 1040.

Use these revised instructions with the 2018 form 5695 rev.

You subtract this credit directly from your tax.

The consolidated appropriations act 2018 extended the credit through december 2017.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

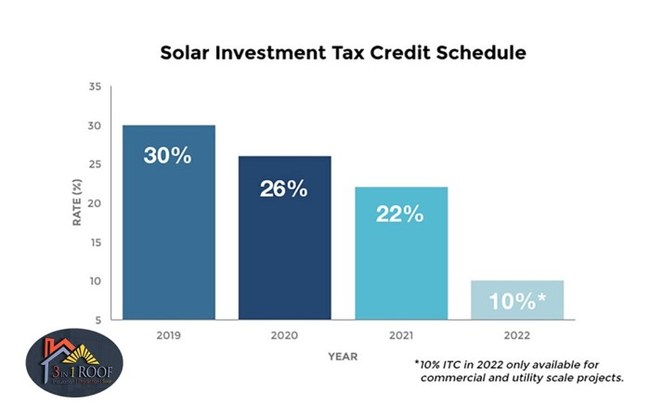

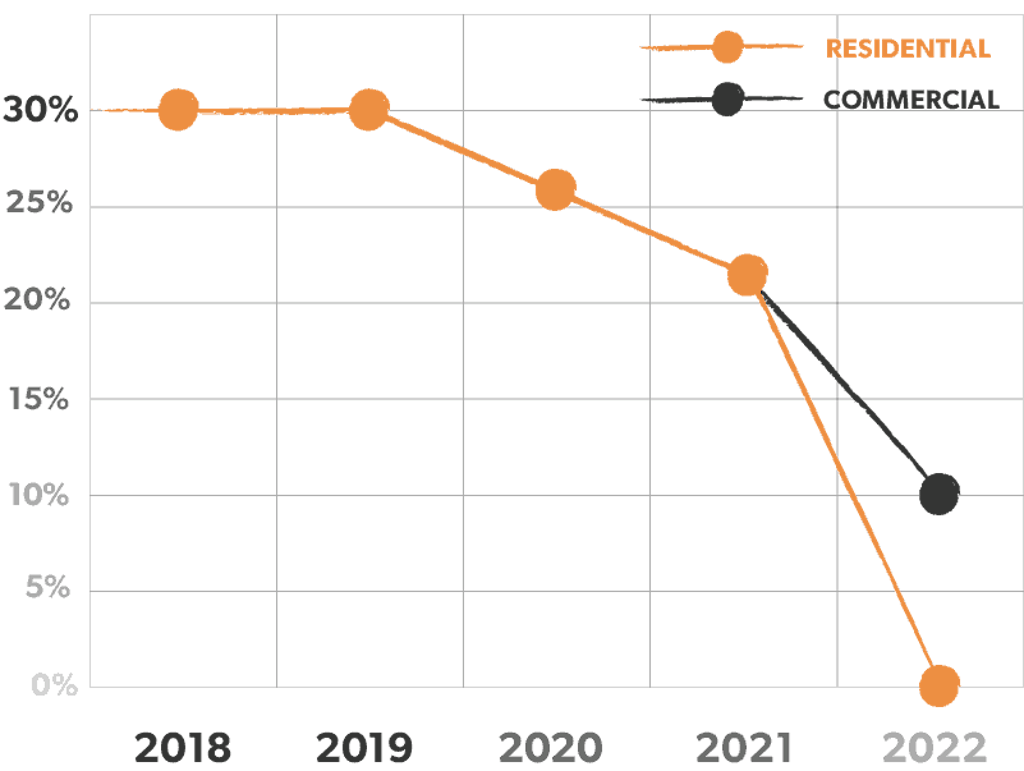

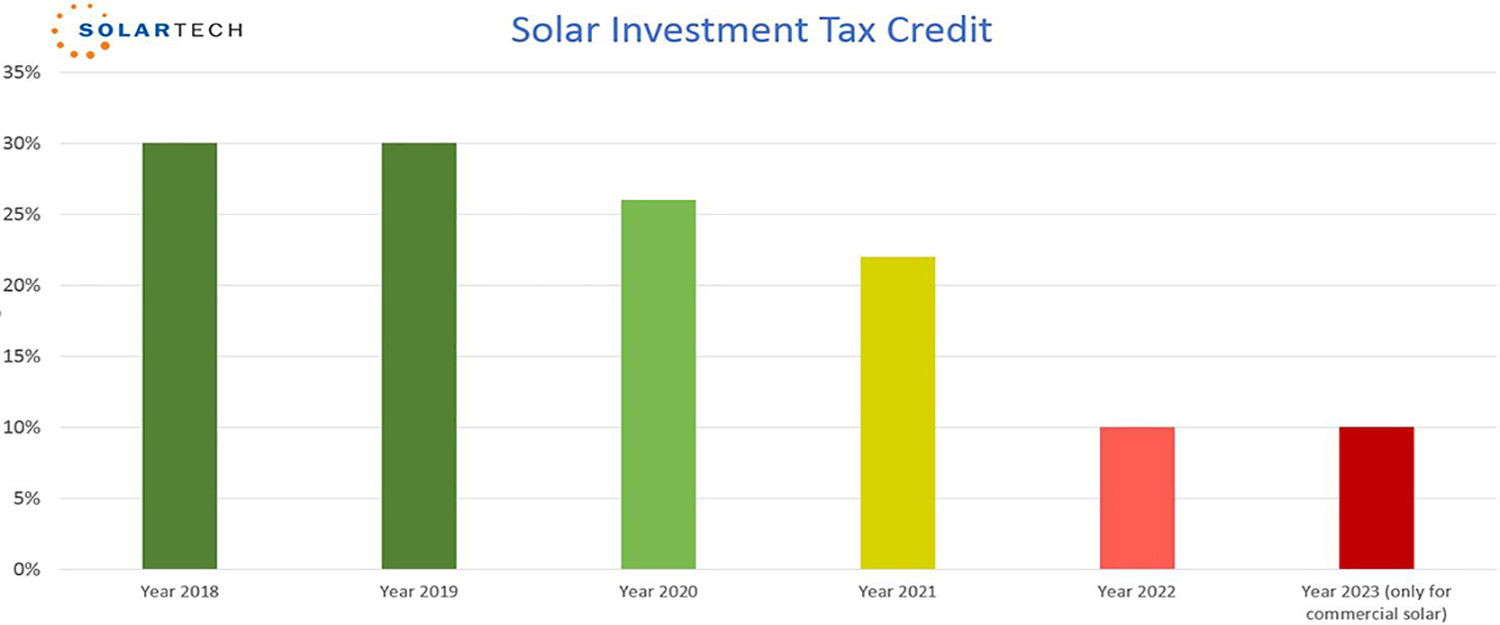

If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc the federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system.