Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the us by 2015 and they predict we will have nearly 100 gw total by the end of 2020.

Solar tax credit example.

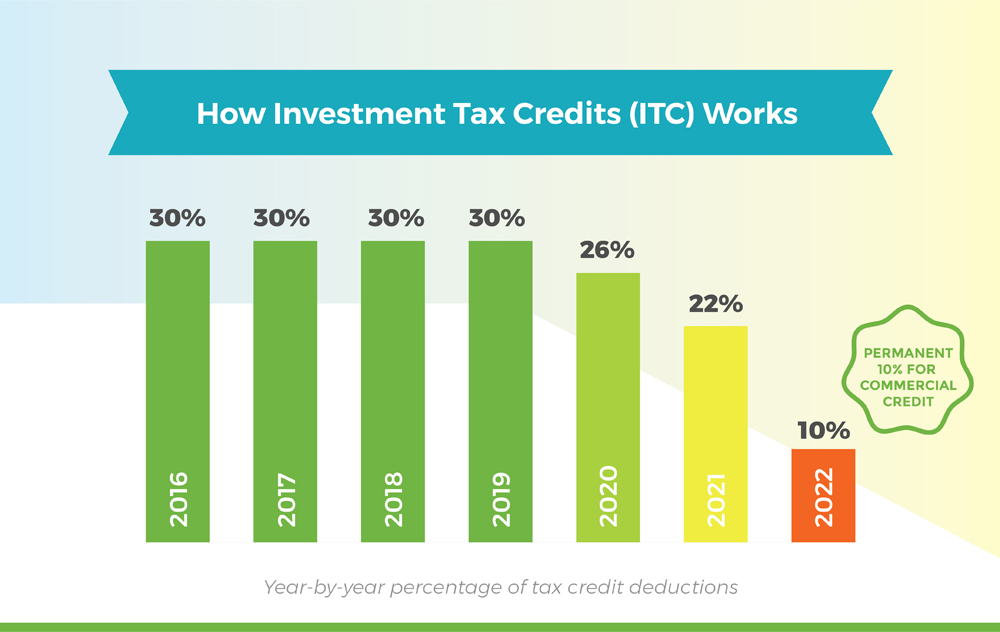

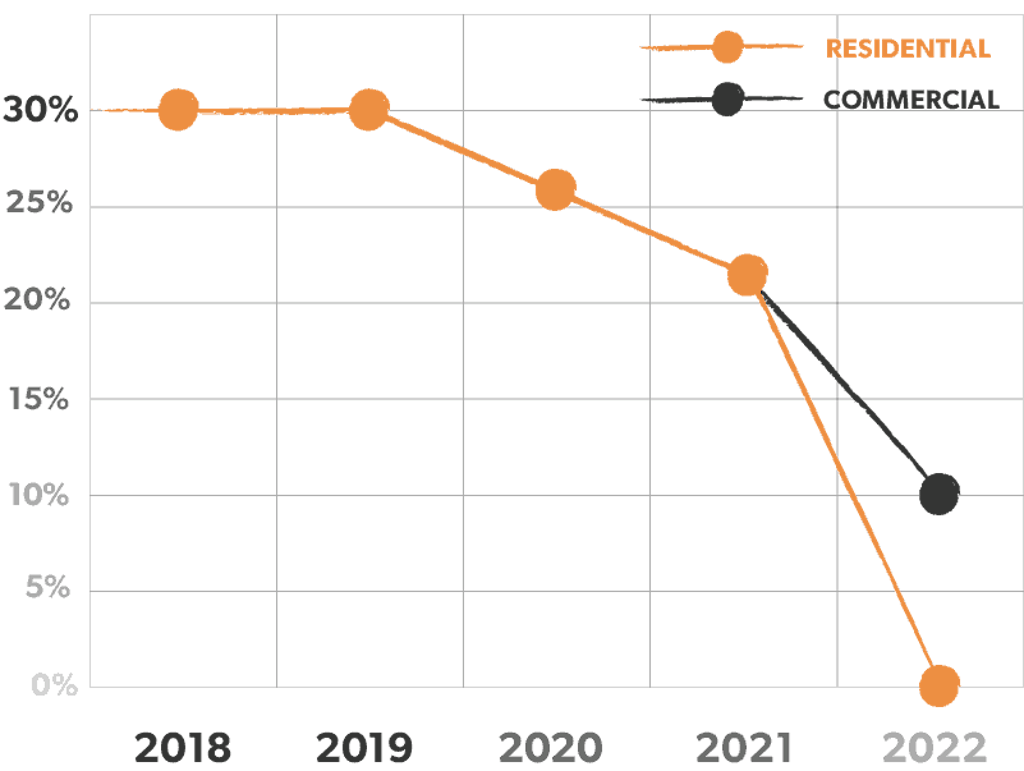

The itc applies to both residential and commercial systems and there is no cap on its value.

0 3 18 000 1 000 5 1007 payment for renewable energy certificates.

At that price the solar tax credit can reduce your federal tax burden by 4 618.

A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe.

Before you calculate your tax credit.

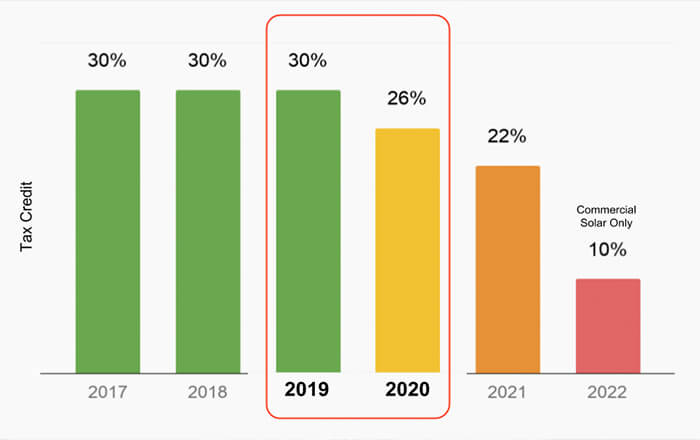

The history of the solar investment tax credit.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

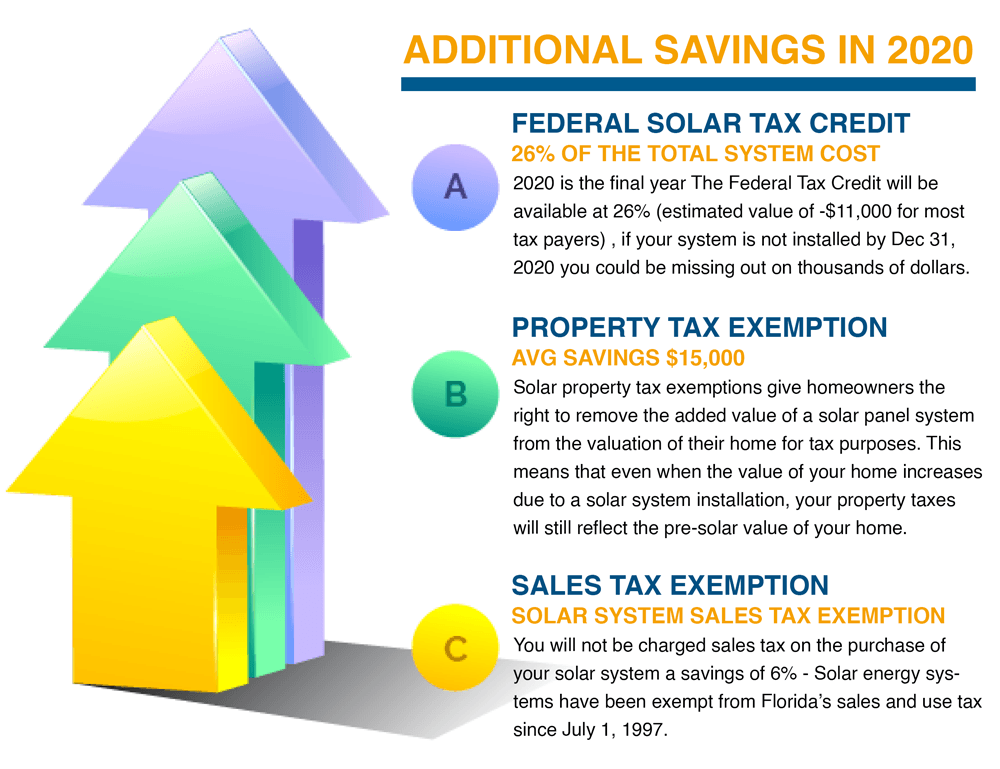

If you spend 10 000 on your system you owe 2 600 less in taxes the following year.

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

When you install a solar system 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return.

For example an average sized residential installation of solar panels in california costs about 17 000.

First you will need to know the qualified solar electric property costs.

The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st century energy systems and technology.

What is the solar investment tax credit.

We ll use the national average gross cost of a solar energy system as an example.

That is the total gross cost of your solar energy system after any cash rebates.

The credit for that system would be 26 of 17 000 or 4 420.

Add that to line 1.

For example if your solar pv system was installed before december 31 2019 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows.

The itc was originally established by the energy policy act of 2005 and was set to expire at the end of 2007.

The federal solar investment investment tax credit itc is a tax credit that can be claimed on federal.

Thanks to the popularity of the itc and its success in supporting the united states transition to a renewable energy economy congress has extended its expiration date multiple times.

_540_449_80.jpg)