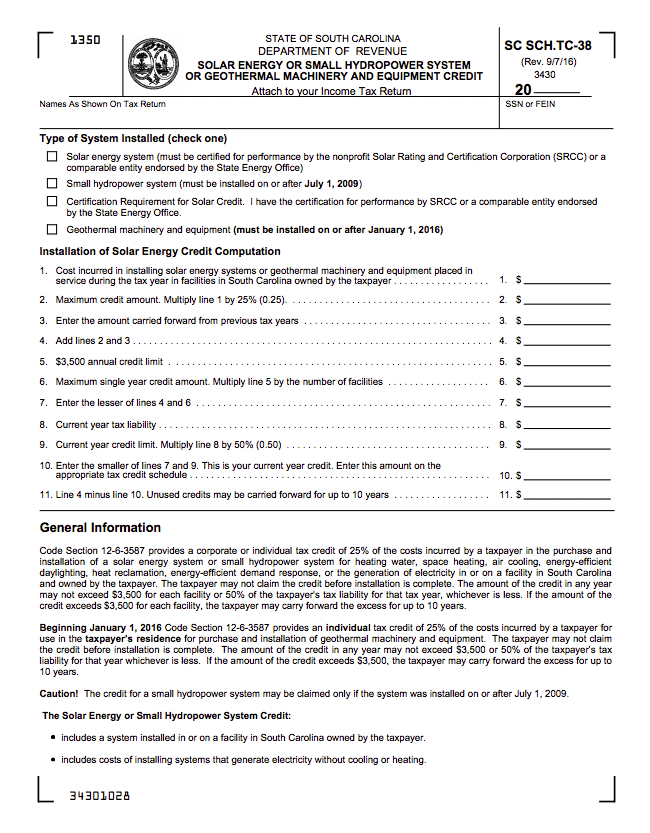

This law provides a tax credit of up to 25 percent on all eligible costs to a maximum of 3500 or 50 percent of a person s tax liability whichever amount is less when applied to the individual s yearly taxes.

South carolina solar tax credit form.

South carolina s tax credits may be earned by individuals c corporations s corporations partnerships sole proprietors and limited liability companies.

For installing a solar energy system or small hydropower system in a south carolina facility tc 38.

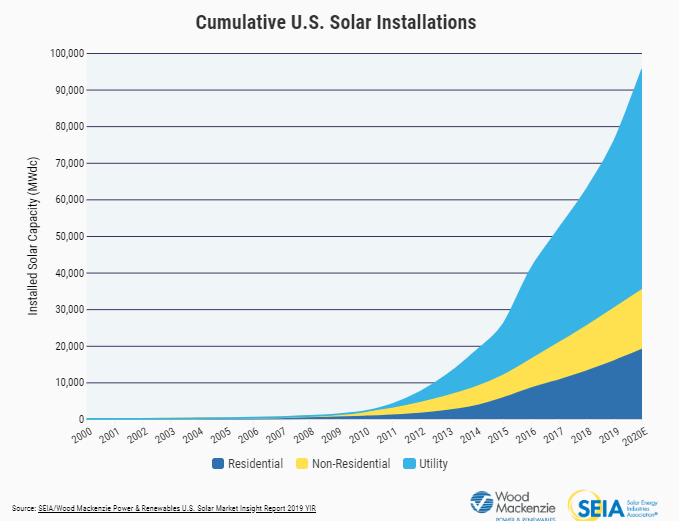

In july 2009 south carolina passed its solar rebate tax incentive law to allow homeowners in the state to claim credits for any renewable energy systems that they installed in their homes.

Residents of the palmetto state can claim 25 percent of their solar costs as a tax credit and if you don t pay enough in taxes to get the full value of the credit in one year it.

General tax credit questions.

Taxcredits dor sc gov angel investor credit parental refundable credit and education donor nonrefundable credit.

South carolina s solar energy tax credit passed by the state legislature lets residents claim a state tax credit of 25 of the whole installed cost of a solar pv system.

The largest credit that can be applied in a single year is 3500 or 50 of your state tax liability whichever is less.

To claim the south carolina tax credit for solar you must file form sc1040tc as part of your state tax return.

Credits are usually used to offset corporate income tax or individual income tax.

South carolina solar energy tax credit cut the cost of installing solar on your home by a quarter with south carolina s state tax credit for solar energy.